The West Texas Intermediate (WTI) crude oil price fell from $105/barrel on Jun 25th to $77 on Nov 5th, a drop of 26.7%, also a 3-year low. Last week, Goldman slashed their oil price forecast for Q1 2015 – expects Brent to be $85/bbl vs. $100 previously AND WTI $75/bbl vs. $90 previously (link). For sure, drillers and frackers will suffer but which businesses will benefit from this free falling crude oil price?

My investment focus is on US diversified and integrated oil refineries which can grow profit margin from the widening price gap between domestic crude oil and international refined oil product. I will discuss 3 investment opportunities at the bottom of this post.

Saudi/OPEC’s pricing power

Thanks to the so-called split-pricing (or discriminative pricing) by Saudi Arabia. What Saudi does is cutting crude prices for U.S. customers while selling at higher price to other countries. OPEC also cut production forecast in Nov-Dec. Apparently, this is a very targeted strategy by Saudi to force the blooming shale oil businesses in U.S. to slow down their production (if not driving them out of business).

$75 dollars a barrel

That’s the price crude oil would have to hit for frackers in North Dakota’s Bakken fields to feel pressure to slow new production, according to Greg Zuckerman, author of “The Frackers” and a special reporter at the Wall Street Journal. “All these guys have hedged. They’ve got production [and] they’ve already got the acreage. They’re not gonna stop but maybe they’ll kind of slow new stuff.”

In other parts of the U.S. the frackers are more resilient to free fall in oil prices this year. In Texas’s Eagle Ford and Permian basin, Zuckerman says oil prices would have to drop as low as $60 a barrel for production to be impacted.

(p.s. the Canadian sands production also becomes uneconomical at this low price for prolonged period. It may deter the approval of the Keystone pipeline bill in the US Congress even with a Republican dominance in the Washington.)

How big is fracking in US?

Analysts say the fracking industry in the US grew from $18.4 billion in 2012 to $26 billion dollars in 2013 (source: BCC Research). We’ve gone from 5 million barrels a day to 9 million in just about 5 or 6 years. The US is producing an additional 3 million barrels a day because of shale oil. Overall, fracking is still a tiny fraction of the overall oil and gas industry in the United States. So, the industry is just in the third inning of a long & impressive revolution. Hard to believe a temporary crude oil over-supply will stop the revolution.

What is the real impact? A Supply Shortage in 2015?

In addition to targeting the US shale revolution, many believe that Saudis have other agendas: to target Iranians and Russian. While Russia supplies most of the the natural gas to Europe, the Ukraine relationship becomes an opportunity for Saudi or US to take market shares by exporting natural gas and other oil products to help free Europe from Russian grandstanding.

Other oil export countries (such as Iraq, Iran, Libya, the North Sea, Venezuela, Nigeria) built their government 2014-2015 budget based on $96-100/barrel. If the oil price continues to fall $60-70, these countries may have budget deficit and are forced to lower their production in 2015. By Q3 2015, we may see a tremendous oil supply constraints, shortage, that, “in turn will lead to the ‘super spike’ albeit from much lower levels than previously predicted” says Dan Dicker, president at MercBloc and author of Oil’s Endless Bid.

CEOs remain confident about profitability even in the world of $75 / barrel

Halliburton (HAL) CEO Dave Lesar is the most out-spoken one. He said that he is not particularly worried about falling oil prices, expecting them to climb next year. Lesar believes the oversupply will quickly prove self-correcting, especially when it comes to U.S. shale production. Unlike with conventional oil, shale wells peter out quickly and companies depend on constant new drilling to maintain production levels; lower prices will discourage new drilling, quickly removing the glut in crude supplies, Lesar says.

“We think there’s a lot of economic oil at $75… meaning we earn 15%, 16%, 17% returns,” Occidental (OXY) CEO Stephen Chazen said during earnings conference call last week.

Execs at several large U.S. shale producers, including CHK, EOG Resources (EOG) and Whiting Petroleum (WILL) said as they reported earnings that they plan to maintain and even raise production. Shale producers cite success in reducing costs as proof they can still be profitable at prices below $70/bbl; CHK says well costs at its two largest production areas – Pennsylvania’s Marcellus Shale and Texas’ Eagle Ford – fell 11% and 13% respectively Y/Y during the first seven months of this year.

Oil Refiners are the winners

Exxon (XOM), Chevron (CVX)’s recent earnings were boosted by refinery as oil prices slip. Both companies reported last Friday cited that 25% drop since July helped profit jump nearly fourfold.

The London-traded Brent Crude is usually higher than the WTI in US because it’s more expensive to drill and transport in Europe/Middle East. So, the European refineries, which ship gasoline and diesel to our shores, must use the pricier Brent Crude. U.S. refiners, meanwhile, can undercut the importers whenever the gap between West Texas and Brent prices widen.

According to Citigroup, the gap may grow further. Citigroup’s analysts expect rising U.S. output to push West Texas prices down even faster than Brent prices. What is now a $5 gap should grow to $8 next year, and $10 in 2016. The key takeaway: U.S. oil refiners will be able to produce gasoline, diesel, jet fuel and other distillates at much lower prices than their peers, setting the stage for rising domestic market share and a rise in exports. (Btw, US government only allows refined product export but not US-produced crude oil. )

Risks to Consider: If U.S. oil producers decide to sharply cut output in the face of falling crude oil price, then the West Texas-Brent spread may narrow, which would negatively impact refinery margins.

For investors in refineries, there are 3 refineries (DK, ALDW, CVRR) on my radar. I did more in-depth research at DK while still reading earning reports for ALDW and CVRR.

1. Delek US Holding, Inc (DK)

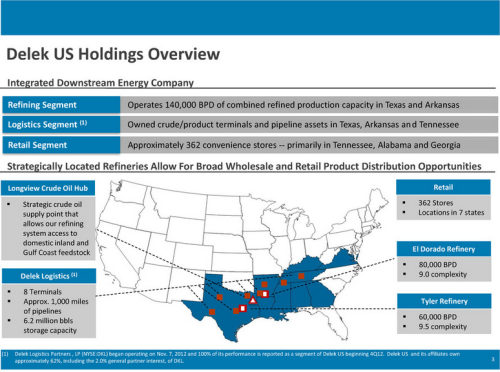

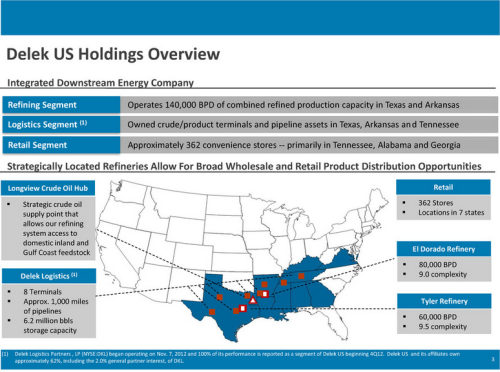

DK is a Texas/Mid-Atlantic based integrated energy business with focuses: petroleum refining, distribution, logistics, and convenience store retailing. Nov 6th’s earning and revenue from Q3 both beats analysts’ estimates (link). (Disclaimer: I am long DK)

DK is a Texas/Mid-Atlantic based integrated energy business with focuses: petroleum refining, distribution, logistics, and convenience store retailing. Nov 6th’s earning and revenue from Q3 both beats analysts’ estimates (link). (Disclaimer: I am long DK)

- IPO in 2006 on NYSE

- $41/share in Feb 2013, dropped to $19 in Oct

- We bought at $19-20/share in 2013 Oct

- Forward P/E: 10.89 (vs. ttm 23), P/S: 0.23, Div Yield: 1.8%

- Major reasons for the significant decline in early 2013:

- Abnormal WTI > Brent spread in early 2013

- Government mandatory Ethanol permit (EPA scaled it back in late 2013)

- Catalysts for upside:

- Successful Tyler expansion in Q1 2015

- Continued expansion of El Dorado

- Growing spread between Midland WTI and Cushing WTI

- Reduced cost in retail store operations

- Current price at $32. 1-year target: $ 48/share. Analysts at Barclays project $50 target price.

2. Alon USA Partners LP (ALDW)

ALDW is a MLP. Forward P/E: 7.05 vs ttm: 8.28, P/S: 0.36.

Citigroup analysts call for 37.6% EPS growth and long term growth rate at 23.9%.

What’s more impressive (if it’ll happen) is that Citigroup forecasts it will generate a $2.64 dividend payment in 2015. That’s a 15% yield, based on current prices. Current dividend yield is 2.6% ($18.81 / share as of Nov 6th).

Citigroup’s $22 target price adds 25% potential share price appreciation to that income stream.

3. CVR Refining, LP (CVRR)

CVRR is a MLP. Forward P/E: 7.76 vs ttm: 8.39, P/S: 0.38, Div Yield: 8.39%.

CVRR suffered a huge setback on July 24th (link) when a fire injured four employees at their Coffeyville refinery and they were forced to shut down its 115K bbl/day production. Coincidentally, Carl Icahn reduced his position in CVRR for $6.5 million shares on July 1st (link). Following this sales, Mr. Ichan still owns over 70% of CVRR.

CVR Refining’s profitability is directly linked to the Brent-WTI spread, which has narrowed considerably in the past few months. Recent low oil price will increase the profit margin of the partnership.

What interests me is its longer-term growth in 2015. From past history, CVRR should be able to reopen the Coffeyville refinery in Nov/Dec and turn it back to full operation in 2015. CVRR management said that they would use the downtown to re-tune, expand Coffeyville and do their yearly maintenance in order to minimize disruption of production.

Investors can also consider bigger refineries – VLO and HFC. Alon USA and CVR Refining, LP offer the prospect of double-digit annual dividend yields, albeit with a high degree of seasonality, while the larger refiners such as Valero (VLO) and HollyFrontier (HFC) appear set to offer solid dividends and ongoing share buybacks.

Read Full Post »

Most of these refineries have more than 60% of the crude feed-stock sourced from Midland Basin in western Texas. Midland has seen tremendous growth in oil production due to proliferation of hydraulic fracking. The lower crude oil price may slow the frackers’ production rate but not a lot.

Most of these refineries have more than 60% of the crude feed-stock sourced from Midland Basin in western Texas. Midland has seen tremendous growth in oil production due to proliferation of hydraulic fracking. The lower crude oil price may slow the frackers’ production rate but not a lot.