Despite myriad concerns about Chinese stock markets, real estate and banking systems, the long view on China is still bullish. Before I talked about why “Hard Landing” is not plausible in China, let me discuss why people are worried about the current Chinese economy.

China Property Bubble Bursting

The discussion of “Hard Landing” in China started in 2012 when thousands of Chinese “Ghost Cities” phenomenon appeared in many tier 2 and 3 cities in China. The situation has not been improving since 2012. The latest real estate and housing data released in China is indeed very bad.

According to FT report, the value of homes sold in the first quarter fell 7.7% yoy to 1.1 trillion yuan. New property construction starts fell 25.2% yoy to 291 million square meters – the largest yoy decline in quarterly data since at least 1997 and the lowest quarterly amount of new floor space started since Q1 2009. In 2014 Q1, there was 7.7% decline in home sales and developers have cut prices in at least five Tier 2 and Tier 3 cities. Basically properties were overbuilt and the overcapacity situation probably requires 4 to 5 years to digest.

Source: FT

Because the government wants to crack down the shadow banking (estimated to top $5.8Trillion yuan) problem and cool down the overheated housing market, the central bank in China has tightened money supply and bank lending since Jan this year. A lot of the small business loans, especially real estate/property related loans are put on hold for more than 5 months. The broadcast measure of financing for the economy fell 9.1% YoY in Q1 to 5.6 trillion yuan.

To make matters worse: many property developers’ cash flows were squeezed by (1) declining home price and home sales in Q1 2014, (2) large land purchases in Q4 2014 (amount went up 41.7% YoY to 136 million square meters) and (3) financial lending is halted by government policy.

Why No Hard Landing?

The above property and bank loans problems seem bad enough to significantly slow down Chinese economy into a danger zone. The “Hard Landing” argument is alive and well. But keep in mind, the current so-called bubble and financial crisis is far from the 2008 US’s sub-prime mortgage situation. Here’s why:

1. Reform is Progressing From Investment to Consumption

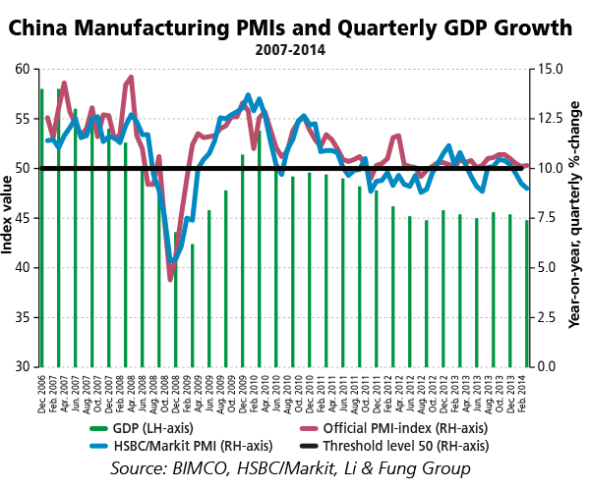

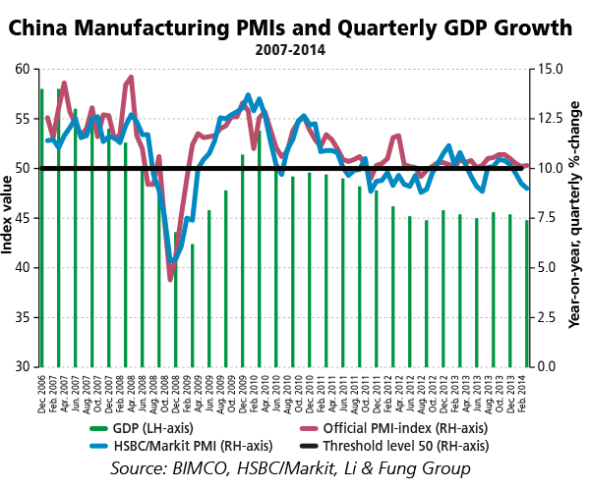

The 2014 first quarter GDP data show progress of Chinese reform. The slowdown in GDP growth from 7.7% in Q4 2012 to 7.4% in Q1 2014, the lowest level since Q2 2012, appears to be largely consistent with policy goals of the Chinese government led by Premier Li Keqiang. The long-term goal of Chinese policymakers is to adjust the economic growth model from the current investment-led one to one driven by consumption.

There are three components that make up GDP – final consumption expenditure (consumption), gross capital formation (investment) and net exports (exports less imports). In the first quarter, consumption accounted for 76.7% of GDP growth, the second highest quarterly percentage in the recorded history. The first highest is 1985 (85.5%). Year-to-date retail sales expanded by 12% YoY while fixed asset investment growth slowed to 17.6% YoY from previous month. Industrial production accelerated modestly from 8.6% to 8.8%.

I am not sure the stock market in China is bottoming out but all these suggest that the economy is moving to the right direction, the soft landing scenario seems plausible.

2. Different Housing Market Characteristics in China vs. U.S.

We should understand that the Chinese housing market characteristics are quite different from those of U.S. First, Home ownership is perceived as a necessity, not a privilege or luxury. As such, owning a home is more important than owning a big home, especially for those young men eager to get married and start new families.

Second, Chinese people are buying properties with cash. Even assuming there is some level of a housing bubble in China, it’s different from the housing bubble that plagued the U.S., in that residential mortgage debt remains relatively low. Chinese residential mortgage debt was 15% of GDP as of 2009, compared to 81% in the U.S., according to the Milken Institute.

In China, there is no Freddie or Fannie to virtually absorb all sour mortgages. A typical residential mortgage in China is a variable, 20-year loan. The 30-year fixed-rate, and enticing, non-transparent financial constructs such as adjustable-rate mortgages or interest-only mortgages are not available to most Chinese home buyers (yet).

3. $3.8 Trillion Foreign Exchange

It’s not likely China will see a hard landing” akin to a meltdown given its $3.8 trillion foreign exchange cash pile and growing middle class. Yu Yongding, a former member of the People’s Bank of China ’s Monetary Policy Committee, says that those who argue for an imminent collapse ignore China’s unique economic situation. He says, “in the worst-imagined case of property prices falling by more than 50%, the government could purchase unsold properties and use them for social housing to support prices and reduce stockpiles while also using some of its nearly $4 trillion of foreign-exchange reserves to inject capital in the banks if they saw a huge rise in non-performing loans from bad mortgages.” His article, Rumors of a Chinese crash are greatly exaggerated, is very much worth a read.

4. Nine Targets in the Capital Market Reforms

Lately, Chinese stocks have not reflected the long-range growth optimism as global investors fear contraction but the recent capital market reforms should spur foreign investment and domestic economic activities.

On May 13, China’s State Council revised 9 guiding principles of regulations for the capital market reforms. The 9 targets can be summarized into 4 areas. First, the government would open up China’s capital market to facilitate the cross-border investment and financing. Second, the government aims at promoting bond, equity, and private equity markets. Third, the government encourages mixed ownership economy, seeking to improve the modern enterprise system and corporate governance structure. Fourth, the government seeks to improve risk control, monitoring, and reporting to encourage higher innovation and more new products.

The guidelines lain down indicate that the government acknowledges fair enforcement of rules and regulations are critical for healthy developments of the capital market.

Taking The Longer View

Despite the sour short-term news, the Chinese government is committed to growth in its long-range plans, and has ample cash to stimulate its economy, should it need to do so. The Chinese are still building infrastructure at a breakneck pace in western and rural parts of China, leading to construction of entire cities. Its long-term goal is to produce an economy driven mostly by domestic demand and not exports.

Although the hyper-growth of more than 10% is already in the past, at its current 7.5-percent expansion rate – compared to 2.5 percent for the U.S. and 1.2 percent for the euro zone – the size of the Chinese economy will eclipse America in roughly five years, possibly sooner, according to a projection by The Economist magazine.

In the interim, the Chinese government has tried to normalize the market as part of its economic reform – it will allow more badly-run state-owned businesses to fail and default on their bad debt. The shadow banking issue could be huge but the government will shrink the size of the problem in a manageable and controllable manner. The Chinese will be ramping up production of everything from computers to vehicles. China may also benefit from falling energy prices and Western sanctions on Russian banks. And a slowly recovering United States and euro zone may only serve to keep China’s export machine humming.

BONUS. Side Note

Besides China and Hong Kong, the return of money to emerging markets in general and Brazil in particular has been well-covered in 2014 Q1. What other countries are working?

- Indonesia: EIDO +24.3% YTD; other ETFs IDX, IDXJ.

- Philippines: EPHE +9.7% YTD.

- Thailand: THD +7.3% YTD.

- Vietnam: VNM +18% YTD.

- India: EPI +8.7% YTD; other ETFs EPI, INDY, SCIF, PIN, INP, INDL, INDA, INXX, SCIN,SMIN

- What’s not: Mexico (EWW) is off 5.5% and Chile (ECH) is down 4.1% YTD.

While lots of the emerging market economies are doing quite well compared to the U.S. so far in 2014, investors should diversify their portfolios with suitable emerging market exposure based on their risk profiles.

Read Full Post »